After years of dormancy, trade between Syria and Iran is stirring to life. Since May, the countries have made progress on deals to remove joint customs tariffs, revive Iran’s automotive plants in Syria, create a joint bank, and even build an insurance company.

It wasn’t long ago that talk of improved economic ties between Tehran and Damascus was just that – talk. Now, however, cooperation has a new deadline: the end of Iranian patience.

Iran has been a steadfast supporter of President Bashar Al Assad since the start of Syria’s civil war in 2011, and Tehran has provided Damascus with financial aid, militias, and weapons throughout the 12-year-long conflict. Confidential documents, allegedly leaked by Iran’s Presidential Institution, reveal the extent of this assistance: an estimated $50 billion in military and non-military backing.

But none of this support was free. On the contrary, Iran viewed it as an investment. Aware that Syria’s financial woes would make cash repayment unlikely, Iran has sought to recover its debts through project-based settlements.

Yet few of these projects have materialized. Long, drawn out negotiations kept many projects in political purgatory. Making matters worse, the Syrian regime granted the lion’s share of new business opportunities to Russia, turning its back on lenders from Tehran.

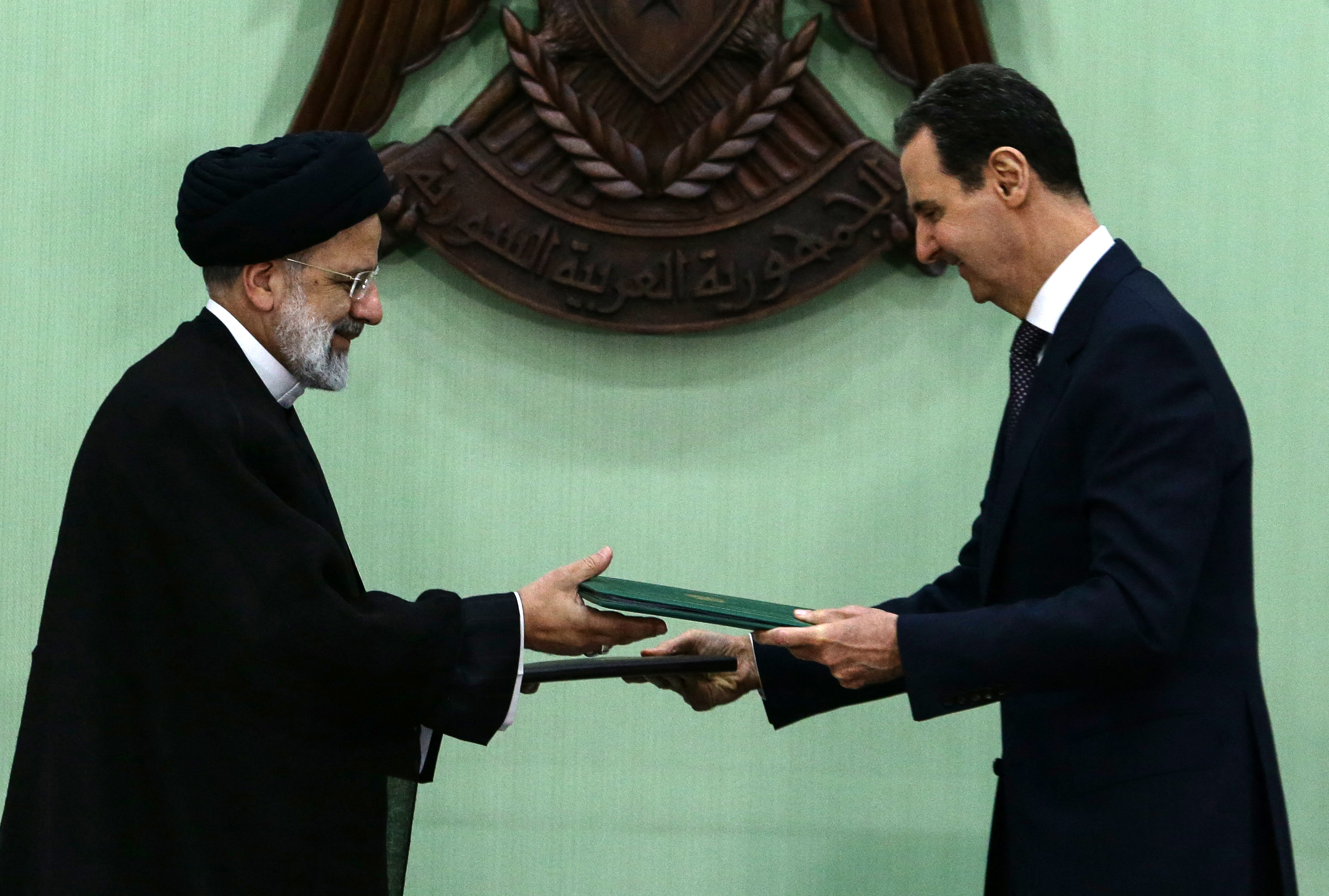

Frustrated, in 2022, Iran began in hopes of converting its substantial support into tangible economic benefits. By employing strategic leverage, such as withholding oil shipments, Iran managed to secure economic concessions during President Ebrahim Raisi’s visit to Damascus in May.

Raisi emphasized expeditious implementation of deals old and new, including agreements on energy, agriculture, transportation, and free trade. Several projects controlled by proxy companies linked to Iran’s Islamic Revolutionary Guard Corps (IRGC) – including a telecoms deal – were also advanced.

In contrast to previous deals, the latest round of announcements – facilitated through intense shuttle negotiations – demonstrates Tehran’s new ability to shape Syria’s trade and import policies. The recent revival of Iranian automobile manufacturing in Syria, halted during the war, is one example.

A new zero-trade tariff agreement between Iran and Syria, unveiled in July, is another. That deal paves the way for businesses, including car assembly plants, to engage in cross-border trade without tariffs.

Iran’s push to revive plans for a joint Iran-Syria bank is particularly noteworthy. Initially agreed upon in 2019, the bank was reportedly registered with the Central Bank of Syria on August 17 and is expected to begin operations soon. (Beyond that, little is known about the financial institution, and the majority shareholder, with 49 percent of stock, is a nameless offshore company registered in Lebanon).

Iran is also moving forward with the establishment of an insurance company, a partnership between Iran’s Alborz Insurance, one of the country’s oldest and largest insurers, and Syria’s Al Aqeelah Insurance Company. Like the bank deal, the insurance plan aims to bolster private Iranian investments in Syria by mitigating the risks associated with operating in the country. This strategy will enable Iran to diversify its investments beyond the Iranian government and IRGC networks.

Finally, Iran has used its influence to accelerate the launch of its mobile telecom operator, Wafa Telecom. Although the initial agreement was signed in 2017, little progress had been made until recently. Wafa has reportedly delivered 500,000 SIM cards and 60 mobile telecom stations to Syria, suggesting that launch is imminent. Interestingly, Wafa’s majority shareholder is owned by the IRGC through shell companies, including a Malaysian entity called Tioman Golden Treasure.

The scope of strategic projects that Iran has long aspired to undertake in Syria is extensive. They include ambitious plans such as the construction of a third oil refinery, connecting Iranian rail service to the Mediterranean port of Latakia, and acquiring control over key assets like ports, airports, agricultural land, and oil fields – notably blocks 21 and 12.

Previously, these projects seemed like distant dreams. Today, they’re rapidly becoming reality.

To be sure, there will now be an increased focus on Iran’s activity in the region, which could complicate its economic plans. Tehran is under scrutiny for its support of Hamas, which launched the large-scale assault into Israel, killing hundreds and sparking Israel’s ongoing bombardment of the Gaza Strip.

But Iran will remain Syria’s benefactor, no matter how this weekend’s attack reshuffles the regional calculus. Syria’s struggling economy, made worse by the country’s ongoing conflict and compounded by Russia’s preoccupation with the Ukraine crisis, has weakened the Assad regime’s negotiating position. Iranian investment is a lifeline Damascus needs. It’s also a means of solidifying dominance over Syria’s economy that Iran has long craved.

Dr. Haid Haid is a Syrian columnist and a consulting associate fellow of Chatham House’s Middle East and North Africa program. X: @HaidHaid22